Employer Tax Credits

START-UP CREDIT

This credit applies to qualified plans (defined contribution and defined benefit plans under IRC Sec. 401(a) and 403(a)), and SEP and SIMPLE plans.

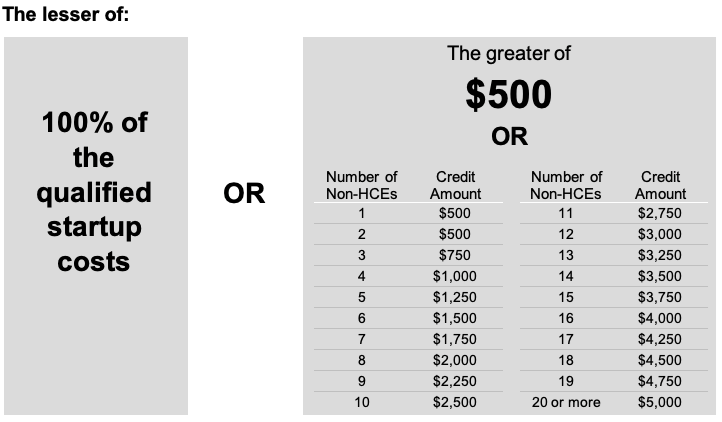

Assuming all other IRS requirements are met for employers who have no more than 50 employees and have at least 1 non-highly compensated employee who is eligible to participate, the maximum credit is 100% of qualified start-up costs, up to $5,000. (For employers with 51 – 100 employees, the existing 50% credit remains unchanged.)

Credit Formula

Example

ABC Company started a plan in 2023 and incurred $4,200 in plan start-up costs during the year. ABC Company has 40 employees and 36 are non-highly compensated employees, or non-HCEs. Under the new law, the credit would be the lesser of their start-up costs ($4,200) or $5,000. Because the employer had more than 20 employees, they would receive a potential credit of $250 for each of the first 20 employees. Since their actual start-up costs are less than $5,000, the credit amount will be $4,200.

CONTRIBUTION CREDIT

This credit applies to qualified plans (defined contribution plans under IRC Sec. 401(a) and 403(a)), and SEP and SIMPLE plans. This credit does not apply to defined benefit plans.

The start-up credit described above is increased for small employers that make contributions for their employees. This credit is not available, however, for contributions made on behalf of employees with more than $100,000 in FICA wages for the year. And contributions to employees that exceed $1,000 cannot be considered.

Employers can receive a credit of 100% of eligible contributions for the first and second years of the plan. The credit is reduced to 75% of eligible contributions in the third year, 50% in the fourth year, 25% in the fifth year, and zero for any taxable year thereafter.

The full credit is available to employers with 50 or fewer employees. The credit is phased out for employers with 51 to 100 employees. Specifically, the amount of the credit will be reduced by an amount equal to 2% for each employee in excess of 50 employees in the prior year.

|

For employers with up to 50 employees (EEs): Additional Credit = Total employer (ER) contribution amount* For employers with more than 50 employees: Additional Credit = (ER ctbn. amt.*) reduced by the [ER ctbn. amt. x (total # of EEs – 50) x 2%] * Employer contribution amount cannot exceed $1,000 for each employee in calculating the credit |

Credit Formulas (employers with up to 50 employees and for those over 50 employees)

Example

Assume that XYZ Company had 56 employees in 2022, the year before establishing the plan. All employees make under $100,000 in compensation and XYZ Company makes a $1,500 contribution to each employee.

To determine the contribution credit, XYZ Company will multiply the 56 employees by the $1,000 maximum credit for a total of $56,000. Because XYZ Company has over 50 employees, they need to reduce the amount of the credit. XYZ Company will multiply the 6 employees over 50 by 2% for a total of 12%. XYZ Company will then multiply $56,000 by the 12% to determine the credit-reduction amount. This would be $6,720. This means the credit for year one would be $49,280 ($56,000 - $6,720).

Assuming that the number of employees stays the same, the credit would be the same for the second year of the plan. The credit would be reduced in years three through five—and then would be eliminated in year six.

Click here for a printable version.