Retroactive First-Year Elective Deferrals for Sole Proprietors

Deadline Change for First Year Deferrals

The SECURE 2.0 Act makes it easier for individuals who own the entire interest in an unincorporated trade or business to make elective deferrals to a 401(k) plan for their first plan year. Beginning with plan years starting after December 29, 2022, sole proprietors and owners of single-member LLCs can establish a plan and fully fund it in the first year by using this provision.

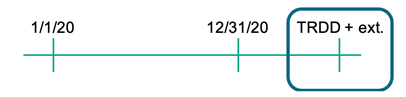

Rule Before 2020

The employer would have to establish the plan by December 31 in order to fund the plan by the tax return due date, plus extensions (TRDD+).

SECURE Act Rule

Under the SECURE Act of 2019 (SECURE 1.0), the employer was given until the tax return due date, plus extensions, to establish and fund the plan.

NOTE: The employer needed to make a deferral election by the last day of the plan year. Practically, this was not possible because the plan was not even established by year end.

SECURE 2.0 Rule

Under SECURE 2.0, an employer can establish and fund the 401(k) plan—including retroactive elective deferrals—by the employer’s individual tax return due date (no extensions).

NOTE: SECURE 2.0 changes the rule—starting with the 2023 plan year—to allow for a retroactive deferral election, eliminating the earlier barrier. But the elective deferrals must be contributed by the employer’s tax return due date, without regard to any extensions.

Click here for a printable version.

This information reflects our understanding based on our analysis and information available as of the date of this publication. Additional guidance provided may affect the accuracy of this content. This material is for informational purposes only and is not intended—nor should it be relied on—as legal, tax, or accounting advice. You should consult with your own competent legal, tax, or accounting advisors.