Five things you need to know if you’re saving in a 401(k) for the first time

Let’s be honest—401(k) plans are seriously underrated. And we don’t mean that in terms of how often they’re utilized, but instead how exciting they are. While many people think of a 401(k) as just another retirement savings vehicle, in reality, 401(k) plans allow workers to save more for retirement than most other savings vehicle—plain and simple. And the opportunity to reach maximum retirement readiness is exciting.

The inner workings of 401(k) plans and the retirement industry in general are complicated, and a little bit of guidance is always needed when so many rules and regulations are put in place. So, without further ado, here are five things you need to know if you’re saving for retirement in a 401(k) plan for the first time.

Important things to know about your 401(k) plan

1. Why is a 401(k) so important to utilize?

It’s no secret that preparing for the future is important, yet many workers still choose not to concern themselves with retirement savings until they’re close to their golden years. This procrastination causes rampant financial stress among today’s workforce, which can be more damaging than you think— leading to sleep deprivation, overeating, substance abuse, health problems, relationship issues, anxiety/depression, and the like. And one of the biggest causes of financial stress? For a large portion of Americans, it’s not saving enough for retirement.

What’s that? You don’t plan on ever retiring?

We’ve heard it all before. This unrealistic ambition is more common than you might think, and while you may not be alone in having the “I’m never retiring” mindset, you’re going to need some serious luck to make it happen. Reality is, 65 percent of workers say they’ll be able to continue working until at least age 65, but less than one in three are actually able to do so. And the main causes of this disheartening statistic are beyond workers’ control; the majority of workers who retire earlier than planned did so because of their own ill health, newfound caregiving responsibilities, or because their employer downsized.1

This makes it vitally important to have a backup plan. Even if you plan on working for the rest of your life, you can’t rely on it—and you need to have strategies in place to safeguard your future. You’ll almost certainly need to replace some portion of your income in retirement, and despite many workers planning to rely on Social Security to fund their retirement, this isn’t a foolproof plan either. Experts say retirees, on average, need to replace between 70-80 percent of their annual income to fund a comfortable retirement, which Social Security benefits don’t even come close to. But here’s the real kicker: for the most part, the more you earn, the more income you’ll be responsible for replacing.

Wait, what?

Social Security benefits are designed to replace a smaller percentage of income for higher earners than for middle- or low-income earners, essentially to help keep lower-income seniors out of poverty in retirement. But it’s important to remember that Social Security benefits were never intended to be the sole source of income for retirees anyway—and it may be a moot point regardless because unless changes are made to the current Social Security system, the Social Security trust fund will be depleted by 2034.

So why a 401(k)? The percentage of workers who are confident in their future retirement outcome is very telling: 83 percent of workers saving in a defined contribution plan, like a 401(k), say they are confident in their ability to live comfortably in retirement—while just 40 percent of workers who are not saving in a defined contribution plan say the same.2 If you’re anything like most people, you probably don’t want to spend the later years of your life wondering how you’re going to get by day-to-day. Suddenly saving in a 401(k) becomes much more appealing.

2. What are the benefits of 401(k) plans?

Now that we’ve laid out why saving in a 401(k) plan is important, let’s get to the benefits. To start, traditional 401(k) contributions are made pre-tax—meaning that you are reducing the amount of your taxable income when you contribute to a 401(k) plan through your employer. Further, this means that you’ll likely receive a bigger refund (or owe less back) at tax time than you would if you didn’t contribute to the plan.

Plus, when you save in a 401(k), you’re giving compounding interest a chance to do what it does best: grow your savings. Compounding interest happens when the interest you earn on your savings/investments begins accruing interest on itself, starting somewhat of a snowball effect for your retirement savings. The more time compounding interest has to do its thing, the better off you’ll be because compounding interest can have major effects on account balances over the course of a career.

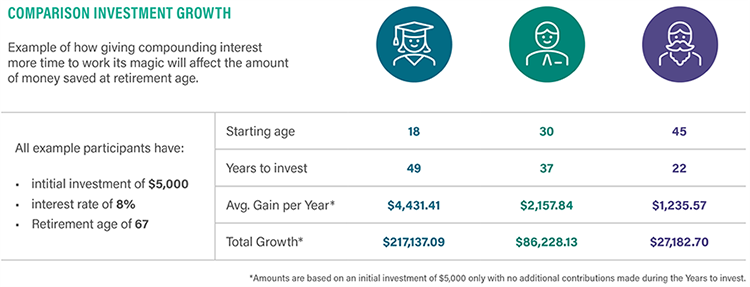

Let’s say three workers begin preparing for retirement at different times in their lives, but they all have three things in common:

- They contributed an initial $5,000 into their 401(k) plan and never contributed to the plan again beyond that initial $5,000 investment.

- They earn an annual interest rate of 8 percent.

- They plan to retire once they reach age 67.

The only real difference in this scenario is the amount of time compounding interest has to work its magic. Let’s take a look.

As you can see from the chart above, compounding interest can have a huge effect on a retirement nest egg when it has time to grow. Despite all three workers investing the exact same amount, the worker who saved at age 18 and gave compounding interest the most time to snowball came out almost $131,000 ahead of the worker who saved at age 30, and almost $190,000 ahead of the worker who saved at age 45.

3. How do I get started saving in a 401(k)?

Before you start saving in your employer’s 401(k) plan, you’ll first want to learn about the plan and familiarize yourself with the basics. Ask your HR director if there are any informational packets or brochures available that detail the plan’s eligibility requirements, the enrollment process, and whether or not there’s an employer match. Some employers impose eligibility restrictions on young workers or new hires, so the first thing you’ll want to do is make sure you are eligible to contribute to the plan. Next, you’ll want to learn about the enrollment process to determine if you are automatically enrolled in the plan when you become eligible or if you’ll need to proactively enroll in the plan when you’d like to contribute. Finally, you’ll want to find out if your employer offers a matching contribution, and if they do, understand what that match means.

Many workers don’t fully understand the terminology when talking about employer matching contributions, and things can get confusing pretty quickly—so let’s clear it up. When talking about an employer match on a 401(k) plan, you’ll often see the phrase “an employer match of X percent on deferrals up to X percent.” Clear as mud, right?

The X’s can be filled with a wide variety of inputs, but for the sake of example, we’ll use an employer match of 50 percent on deferrals up to 6 percent—a somewhat common matching agreement. This essentially means that the employer agrees to match 50 percent of the money you put into your 401(k), up to 6 percent of your total salary. We’ll make it simple—if you make $50,000 annually and contribute 6 percent of your salary to your 401(k), you’ll be contributing $3,000. Your employer will contribute $1,500 to your account, or 50 percent of your contribution up to that 6 percent of your annual pay.

If instead you elect to save 10% of your total salary, you’d be contributing $5,000 into your 401(k), but your employer would still match only $1,500 because the 50 percent match only applies to the first 6% of your salary. This is referred to as the “full employer match.” You’ll often hear financial gurus say it’s advantageous to save enough to earn the full employer match or you’re “leaving free money on the table.” This essentially means you should contribute at least the amount of the second X, or 6 percent in this example, to max out the contributions your employer makes on your behalf.

4. How much should I contribute to a 401(k)?

Determining how much to contribute to your 401(k) plan is a deeply personal decision and should reflect your individual situation—but we’ll cover that part of it in more detail in a minute. Before getting into the nitty gritty of how much to contribute to your 401(k), you’ll first need to know that there are limits to how much you can put in each year. Every year, 401(k) maximum contribution limits are adjusted to reflect the current cost of living, so make sure you stay up to date on how much you can put in on an annual basis.

The first step for determining how much you should contribute to your 401(k) plan is to determine how much you can afford to contribute to your 401(k) plan. Don’t feel discouraged if you can only afford to save a small percentage of your paycheck—there’s no shame in starting slow.

Experts suggest saving 10-15 percent of your annual income for retirement, but again, any money going towards retirement savings is better than none at all. Every worker’s individual situation is unique, and we’re not here to pass judgment on how much you can afford to save. We are, however, here to make sure that you’re retirement-ready when the time comes—so start small if you have to, but be sure to increase your contribution percentage as time goes on so you can meet your retirement goals.

5. What do I do with my 401(k) if I change jobs?

Most workers change jobs at least once throughout their career, and it can be hard to know what to do with your 401(k) savings when you leave one employer’s plan to join another. Before doing anything with the funds in your old employer’s plan, make sure you check the 401(k) Plan Document to determine which actions are allowed. Under normal circumstances, you’ll likely have a few options for what you can do with the money in your old employer’s 401(k) plan:

- Roll the assets into an IRA plan

- Keep the assets in the old employer’s plan, if allowed in the plan document

- Roll the funds over into the new employer’s plan, if permitted

- Take a cash distribution

How to locate a 401(k) from a previous job

The final option should be seen as a last resort; while it may be nice to receive a quick boost in your wallet or personal savings account, you’ll be hit with some hefty penalties and taxes for your “early withdrawal.” In most instances, you must wait until you reach age 59 ½ before accessing your 401(k) funds penalty-free, so distributions prior to reaching that age may be subject to a 10 percent penalty, for starters. Plus, the distribution you receive will be taxable as ordinary income—which could potentially put you in a higher tax bracket for the year. Rolling your assets over into a new retirement savings vehicle or keeping them where they are, if allowed, is perhaps the best option to reach maximum retirement readiness when the time comes.

And that’s the main goal, after all, right? You’re taking an important first step in getting there by saving in your employer’s 401(k) plan, but if you need help along the way, we’ve got you covered. We have a variety of retirement saving tips and educational information available on our website to walk you through the savings journey and, ultimately, help guide you along the path to retirement readiness.

Sources:

1“2022 RCS Fact Sheet #2, Expectations about Retirement.” Accessed March 17, 2023.

2“2022 RCS Fact Sheet #1, Retirement Confidence.” Accessed March 17, 2023.